Price: $1.07

Market Cap: $170M

Cash: $130m

LT Debt: $93M

I hope that everyone’s new year is off to a good start.

Today I want to go over GoPro, I am assuming the company, and its products do not need an intro, but here it goes.

I will go over the main point of the thesis, the key variables of what will make or break the company.

Business: GoPro produces high-quality, compact, and rugged cameras designed primarily for capturing action, adventure, and extreme sports. It was founded in 2002 by Nick Woodman in California, USA.

First Product: The original GoPro was a 35mm film camera mounted on a wrist strap. It debuted in 2004 and was marketed as an affordable and easy-to-use camera for action sports enthusiasts. By 2014, GoPro became a leader in the action camera market, known for its high-quality video, durability, and versatility.

IPO: GoPro went public in 2014 on the NASDAQ, with its stock soaring initially, highlighting the brand’s strong consumer appeal.

Initial Valuation: GoPro's market capitalization was approximately $2.95 billion on its first trading day @$24 a share. GoPro's market cap peaked later in 2014 at over $11 billion as excitement around the brand and its products grew.

The business today:

They report 2 main segments, Hardware +-90% of the revenue and Subscription & service+-10% of the revenue.

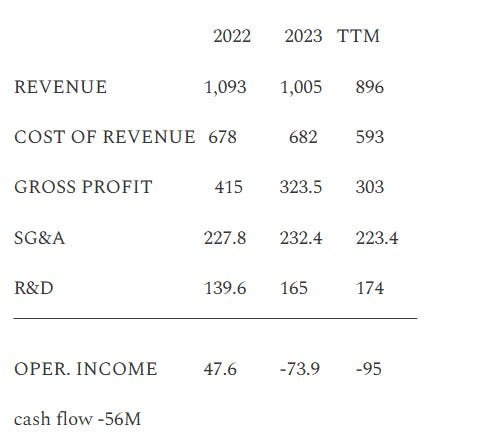

2022 revenue: 1.09B -5.82% YOY

2023 revenue: 1.05B -8.05% YOY

TTM revenue: .89B -13.10% YOY

This decline occurred while expanding retail locations. Since 2023 they added 6,300 new doors (+25%) to a total of 25,000 doors.

Current financials

The main reason for the business decline and Key Variable is a fundamental issue which will not be going way anytime soon because of competition in its own products, and declining demand.

Rising Rivals: Competitors like DJI, Sony, and Insta360 have developed advanced cameras offering features such as 360-degree video, better stabilization, and more competitive pricing.

Smartphone Evolution: The improvement of smartphone cameras, including waterproof designs and advanced video capabilities, has reduced the demand for dedicated action cameras. Social media trends have shifted consumer needs toward devices offering real-time sharing capabilities, an area where smartphones excel.

This reason is IMO the predictive path for the stock to inevitably fail because of the evolution of the smartphone camera which is becoming more advanced and is the main selling points of today’s smartphone. This will accelerate the decline of the business regardless of if GoPro’s technology is superior to their competition.

Catalyst:

GoPro has a $93M convertible debt at approximately $9.33 per share due in November 2025. The current interest rate is1.25%.

Management is aware of this looming crisis and is targeting a $110M of expense reduction by reducing a 26% headcount. The key question is, will this save the day?

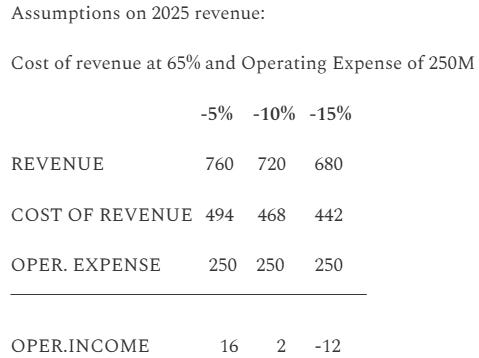

Management 2025 forecasts revenue to be lower than 2024.

Full 2024 revenue is expected to be $800 million which is 20% lower than 2023.

2024 operating expense is assuming to be between 245-255M.

These numbers are generously assuming that management will not have extra associated cost of this headcount reduction.

R&D expense.

R&D expense have been increasing from 2020 at 123M to 2024 at 174m.

This is a digital camera company that has to constantly develop new technology to be a step ahead of the competition.

Reducing R&D expense (a 20% cost of the revenue) will further erode the advantage of the products; while in the short run it will extends its life support, in the long run it will be its own deathblow.

Let’s assume it will have a $100M cash balance in November 2025. The company will most likely still be cash flow negative or slightly positive. That is assuming the refinance of the debt will be at10% which will result in an extra $9M expense. it’s an unlikely scenario that it can be cash flow positive and support a+- $9M interest payment. It looks like bankruptcy is inevitable. They would need to use all their cash to pay off the debt and the business will have to close its doors.

Cashflow currently is supported by a 30M stock-based compensation. A declining stock price could lead to higher dilution if they need to raise the compensation.

The best-case scenario would be to assume that after their 20% decline YOY, 2025 will be -5%. In that case, operating income would be 16M; however, if they refinance the debt at 10% at $9M leaving 7M in operating profits.

At today’s valuation of 170M- this looks like a very asymmetric opportunity.

There is a very strong possibility that by November its going bankrupt ( -10% revenue)

In the event of getting a refinance by November, the valuation should readjust reflecting almost no income.

Reducing expenses will erode the competitive advantage.

This newsletter is not investment advice and is for informational purposes only

The author may be short or long and change their mind about their position.